Blog

2023 — Onward and Upwards for African economies

Africa’s recovery, like many countries was vastly interrupted in 2022 with the external spill overs from the Russia-Ukraine unrest and the after effects of the covid-19 pandemic. It should be noted that before this particular shock, many Sub-Saharan African countries were recording stellar overall growth projected at 3.2 percent in 2019 and rise to 3.6 percent in 20201.

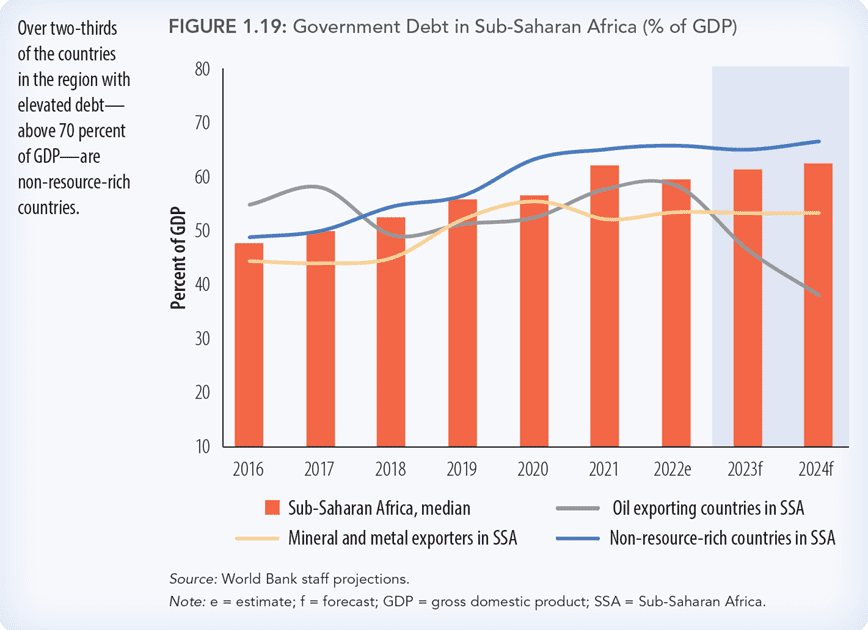

Nonetheless, African economy remain on the peddle stool given the policy redirection. For starters, there appears to be a call for consolidating public finances amid tighter financial conditions in the wake of the covid-19 pandemic. For instance, as highlighted by the International Monetary Fund, regional debt is approaching levels last seen in the early 2000s before the impact of the Heavily Indebted Poor Countries Initiative2. By and large, the pandemic saw to this. Moreso, the monetary tightening is set to have an impact as interest rates across the board are set to rise therein tightening access to cheap money.

Overview

It should be noted that the continent achieved average real annual GDP growth of 5.4% between 2000 and 2010, adding $78 billion annually to GDP (in 2015 prices)3. As noted by McKinsey at the time, much of this growth was attributed to the young and growing population and will as projections showed that by 2034, the region would have a larger workforce than either China or India with job creation outpacing growth in the labour force. This golden decade also saw and acceleration in technology across the continent which in turn unlocked new opportunities for consumers and businesses. Buoyed by these catalysts, consumer spending soared to $4 trillion4.

2023: The time is now…

Sub-Saharan Africa’s strong economic growth over the past decade is a clear reminder of the potential the continent possesses given a clear path toward broad-based economic development. The trajectory is clearly attested by the emergence of an African middle class with new entries like Tanzania and Mauritius and with the right policy adjustments, 2023 could be the year for lift-off.

The recovery continues. More of the same in 2023

As the globe continues its recovery from the novel coronavirus, economic growth in projections show that Sub-Saharan Africa is expected to slow to 3.3 percent in 2022, from 4.1 percent in 2021. Much of this can be attributed to the recovery and the lost covid-19 years not to mention rising inflation, fuel prices aggravated by the war in Ukraine and the ever-present risk of debt distress5.

Estimates from the World Bank paint an even grimmer picture showing that region’s estimated per capita income growth of 0.7 percent for 2022 is inadequate to meet the challenging goals of poverty reduction. As per these estimates, the slow recovery of the per capita income growth rate, only ascertains the regions’ path back to the pre-pandemic poverty reduction path.

Another challenge in 2023 is the rising public debt and depleted fiscal space in many Sub-Saharan African countries. With the health crisis triggered by the covid-19 pandemic, many African countries borrowed and the same rising borrowing costs have all but depleted public savings.

Today, estimates show that the region’s primary deficit expanded during the pandemic to 6.3 percent of GDP in 2020 (from 4.1 percent of GDP in 2019). As expected, the immense debt meant that governments have dedicated the past two years towards debt servicing and this has meant that a larger share has meant to servicing costs. World Bank estimates place the external debt servicing figure at 16.5 percent in 2021, up from less than 5 percent in 20106.

Sadly, this has repercussions as the effects of high debt service costs piled up with depreciating domestic currencies means heightened exchange rate risks for countries with high external debt.

The AFCFTA: The antidote

African Continental Free Trade Agreement (AfCFTA) was signed to boost intra-trade and to increase not only economic welfare, but also living standards. Much as many critics have come out to highlight the shortcomings of regional integration at this level, recent studies have showed that the AfCFTA will benefit many African nations. Notably recent studies highlight how regional integration at the level of the AfCFTA would exhibit gains and losses for different countries7. Their research highlights the gains for West African economies; concluding that there are positive gains in terms of trade creation for Ghana, Mali, Nigeria and Senegal which would outweigh the trade diversion; in addition to a positive consumer surplus and welfare effect values for all ECOWAS economies.

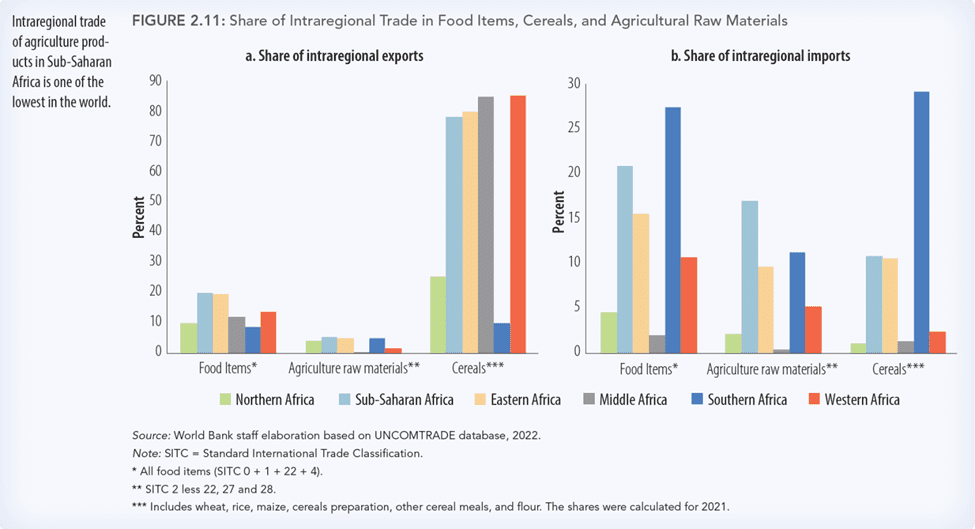

It goes without saying that fostering trade and regional integration can help African countries increase their resilience to shocks affecting global food value chains.

In addition, regional trade agreements and the AfCFTA can help coordinate investment and production at the regional level. Studies have also showed the role of the AfCFTA in buoying trade. According to the World Bank, agriculture and food exports are expected to grow by as high as 80 percent following the implementation of the AfCFTA, while agricultural intra-Africa trade is expected to rise by 49 percent.

As one would recall, the AfCFTA seeks to triple trade in agricultural goods within the region by 2025 and enhancing the continent’s food security through regional supply chains and greater intra-Africa trade. By far 2023 would be the opportune time to capitalise on the AfCFTA.

2023, the year for export diversification

It goes without saying that export diversification could offer many African economies catalytic firepower in 2023. Many African economies offer a wide range of products but value addition is a going concern.

An entry point in 2023 is trade partners. As one might recall, China was Africa’s loyal trade partner during the Sino expansion but with the slow down and the pandemic, that changed. Presented in an uncertain trade environment, Africa can step into opportunities to be suppliers of goods that are in high demand with numerous partners and command prices.

Enhanced value chain development in 2023

The past two decades have seen intense globalisation and a rapid shift of global food value chains and in turn, this has induced development of rural labour markets ergo, poverty reduction.

If the continent can harness the power of trade integration, then this can ignite the agri-business revolution which will transform the agri-food value chains. As an example, the development and modernization of midstream segments of agri-food value chains such as processing, storage, transport, wholesale, retail, and food service can increase food life but also enable farmers to access domestic and global markets and create opportunities for the unemployed youth.

In addition, 2023 can be the year to scale up climate-smart agriculture which is in line with sustainable growth in Sub-Saharan Africa. Much of the policy recommendations today in line with the SDRs recommends the use of clean technologies along the agri-food value chain which is by far a win- win. Relying on technological advancements, novel ideas such as precision agriculture is an example of productivity-enhancing disruptive technologies. As studied by the World Bank, many precision innovations can be developed by start-ups as they require little capital. A notable example is “HelloTractor” in Kenya which is a sharing application that allows smallholder farms to request and pay for tractor services through text messages on a just-in-time basis8. The results are immense as farmers have recorded yield increases of as much as 200 percent since its launch in 2014.

This is perhaps an avenue that can create immense reward from mere value addition.

In conclusion, Africa presents immense potential in 2023. Sectors such as agriculture still contribute immensely to GDP and these have witnessed immense changes since the early 2000s. However, with the policy redirection the stage seems set for a catalytic shift.

On the policy end, there need to be a clear restructure to aid to private sector development so as to widen the arable land acreage with modern tools such as irrigation facilities. In any event, the light at the end of the tunnel has never been brighter…

References.

1 International Monetary Fund. (2019). Sub-Saharan Africa Regional Economic Outlook: Navigating Uncertainty. https://www.imf.org/en/Publications/REO/SSA/Issues/2019/10/01/sreo1019#:~:text=Executive%20Summary,Download&text=Growth%20in%20sub%2DSaharan%20Africa%20is%20projected%20to%20remain%20at,to%20a%20challenging%20external%20environment

2 International Monetary Fund. (2022). Living on the Edge. https://www.imf.org/en/Publications/REO/SSA/Issues/2022/10/14/regional-economic-outlook-for-sub-saharan-africa-october-2022

3 World Economic Forum. (2016). 3 reasons things are looking up for African economies. https://www.weforum.org/agenda/2016/05/what-s-the-future-of-economic-growth-in-africa/

4 McKinsey & Company. (2016). Lions On the Move II: Realizing the Potential of Africa’s Economies. https://www.mckinsey.com/featured-insights/middle-east-and-africa/lions-on-the-move-realizing-the-potential-of-africas-economies

5 World Bank Group. (2022). Africa Economic Report. https://www.worldbank.org/en/region/afr/overview#:~:text=Economic%20growth%20in%20Sub%2DSaharan%20Africa%20(SSA)%20is%20set,rising%20risk%20of%20debt%20distress

6 World Bank Group. (2022). Africa’s Pulse. https://www.worldbank.org/en/publication/africa-pulse

7 Pasara, Michael & Dunga, Steven. (2020). Who Wins and Who Loses Under the AfCFTA? A Simulation Analysis Across Ecowas Countries. International Journal of Economics and Finance Studies. 12. 487-504. 10.34109/ijefs.202012215

8 Fortune Magazine. (2021). Hello Tractor is revolutionizing farming in Africa by connecting farmers to essential resources. https://fortune.com/2021/12/01/hello-tractor-smallhold-farmers-africa/