Blog

Investing in green bonds to bridge climate inequalities

Experts suggest that Green Bonds could be the perfect solution to address the pressing need for increased climate investment in Africa. Developing nations, disillusioned by broken promises from wealthier countries regarding climate financing, are seeking alternative financial models to meet their growing climate action requirements.

Africa remains the most underdeveloped continent globally, with over 70% of the world’s least developed countries (LDCs) located there. Despite contributing the least to climate change, these countries are the most vulnerable to its impacts. According to the United Nations Environment Programme (UNEP), LDCs will have to spend up to five times more on adapting to the climate crisis than on healthcare. Meanwhile, the G20 countries, responsible for approximately 75% of global greenhouse gas emissions, have consistently failed to fulfill their pledges and promises to assist these vulnerable communities in recovering from extreme climatic conditions.

The 2022 United Nations Climate Change Conference (COP27) held in Sharm el-Sheikh, Egypt, concluded with the establishment of a Loss and Damage Fund. The 2022 Adaptation Gap Report by UNEP indicates that developing countries will require over US$300 billion per year by 2030 to mitigate the losses and damages caused by the climate crisis. However, meaningful progress in contributing to this fund has yet to be seen.

“African countries are leading the way on Climate Action. Their massive efforts need massive support. I urge developed countries to deliver on their promises to developing countries and the loss and damage fund agreed at COP 27,” stated UN Secretary-General Antonio Gutterres during a recent address in Nairobi, Kenya.

To expand climate funding options, African countries should consider Green Bonds. These bonds offer a financing model that directs funds directly to projects that have been largely untapped by the majority of African nations. Green Bonds, as defined by the Green Bond Principles, are bond instruments where the proceeds are exclusively used to finance or refinance new and/or existing eligible green projects. They are sometimes referred to as Green, Social, and Sustainable (GSS) bonds.

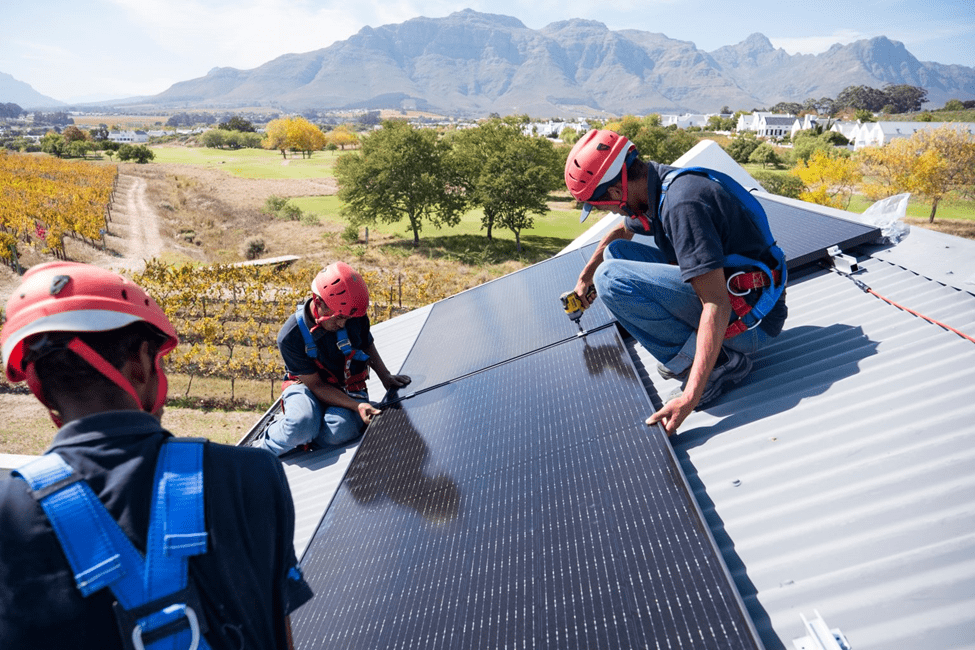

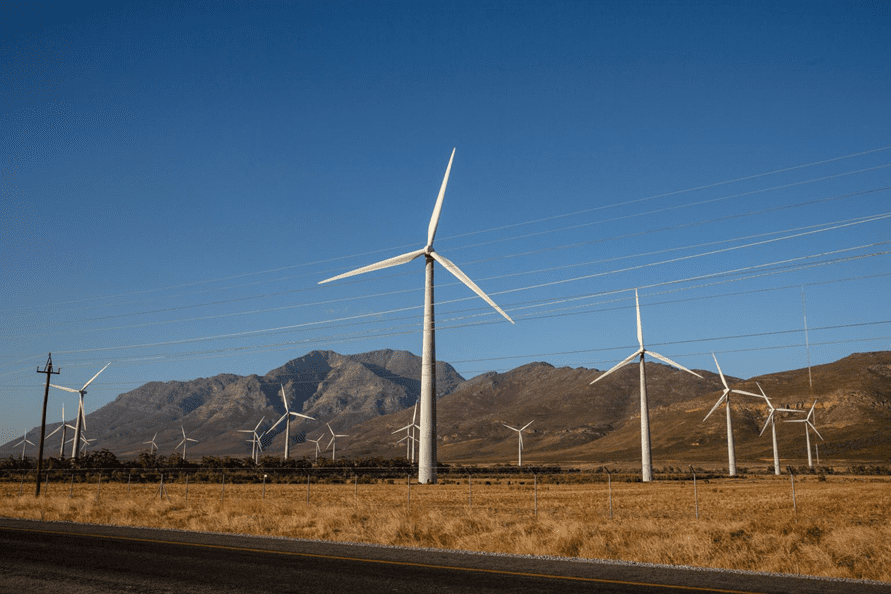

Given the substantial investor demand and the need for funds to support Africa’s sustainable investment requirements, Green Bonds are an ideal solution. The proceeds raised from these bonds can be earmarked for environmentally sustainable projects in areas such as energy efficiency, renewable energy, low-carbon transport, green buildings, smart grids, and climate-smart agriculture and forestry. Africa has abundant untapped resources, including attractive solar resources, untapped geothermal capacity, and unexploited wind sites, making it an ideal candidate for renewable energy projects financed through green bonds.

Furthermore, Green Bonds meet investor demand by prioritizing sustainability and supporting projects with positive environmental impacts. The European Investment Bank issued the world’s first green bond, the Climate Awareness Bond (CAB), in 2007. In Africa, Nigeria issued the continent’s first sovereign green bond, raising $29 million in 2017. Between 2007 and 2019, there was a 300% increase in the issuance of Green Bonds in Africa. However, external crises such as the Covid-19 pandemic and the Russian invasion of Ukraine led to a decline in issuance in the past two years. Nonetheless, market indicators suggest a favorable and competitive business environment in the near future.

According to data from the Brookings Institution, Africa accounts for only 0.4% of global green bond issuance, significantly lower than its 17% share of the global population and 3% share of global GDP. The African Development Bank (AfDB) has played a key role in supporting the growth of African green bonds. The Green Bond Project, launched in 2013, aims to help Africa transition gradually to green growth, protecting livelihoods, improving water, energy, and food security, as well as promote the sustainable use of natural resources to spur innovation, job creation and economic development”.

AfDB has since issued bonds every year apart from 2020, at the height of the Covid-19 pandemic. Bonds have been issued in US dollars, Australian dollars and Swedish krona, although none yet in African currencies. Over 70% of Africa’s green bonds have been issued in South Africa, with Morocco and Nigeria responsible for a further 23%, but other countries are entering the market. Most recently, in July 2021 Benin sold a €500m 14-year SDG bond, suggesting that smaller economies can also consider such bonds as a source of financing.

As of 2022, the success of the issues, including the number of governments that have expressed an interest in issuing green bonds, paints a positive picture. It’s likely that the market will take off in the near future at least with regard to sovereign debt. Other issuers include the

Moroccan Agency for Sustainable Energy, which issued Africa’s first certified climate bond in 2016, raising $104m, and the West African Development Bank (BOAD), with €750m in 2021.

Most African corporate green bonds to date have been issued by banks, particularly in South Africa. There have only been four sovereign issuers of Green Bonds. Most recently in January, South Africa’s Nedbank issued a green bond in conjunction with the International Finance Corporation (IFC) to raise R1.09bn ($75m) to build environmentally sustainable housing

In May last year, the IMF revealed that the key for the success of Green Bond investment is sharing information about the Green Bonds market internationally and it’s potential in West Africa.

“Financing the critical needs of green growth and adaptation in Africa is a core mandate of the World Bank. Green and sustainable bonds, together with the increased level of transparency that they bring with them, can help many countries in the region in their journey towards securing market financing for future investments,” said Jorge Familiar, World Bank Vice President and Treasurer.

Countries like Australia and Sweden have recorded massive profit from green bonds. In June this year, Western Australia’s government said it has raised $1.29 billion through the state’s first green bond issue, with the funds going towards replacing ageing coal-fired power plants with wind and solar.

It is therefore the responsibility of African states in partnership with key players in the finance sector to look into this new frontier of finance and exploit it to the fullest.

Citations

Ngwenya, Nomhle, and Mulala D. Simatele. “The emergence of green bonds as an integral component of climate finance in South Africa.” South African Journal of Science 116.1-2 (2020): 1-3.

Ngwenya, Nomhle, and Mulala Danny Simatele. “Unbundling of the green bond market in the economic hubs of Africa: Case study of Kenya, Nigeria and South Africa.” Development Southern Africa 37.6 (2020): 888-903.